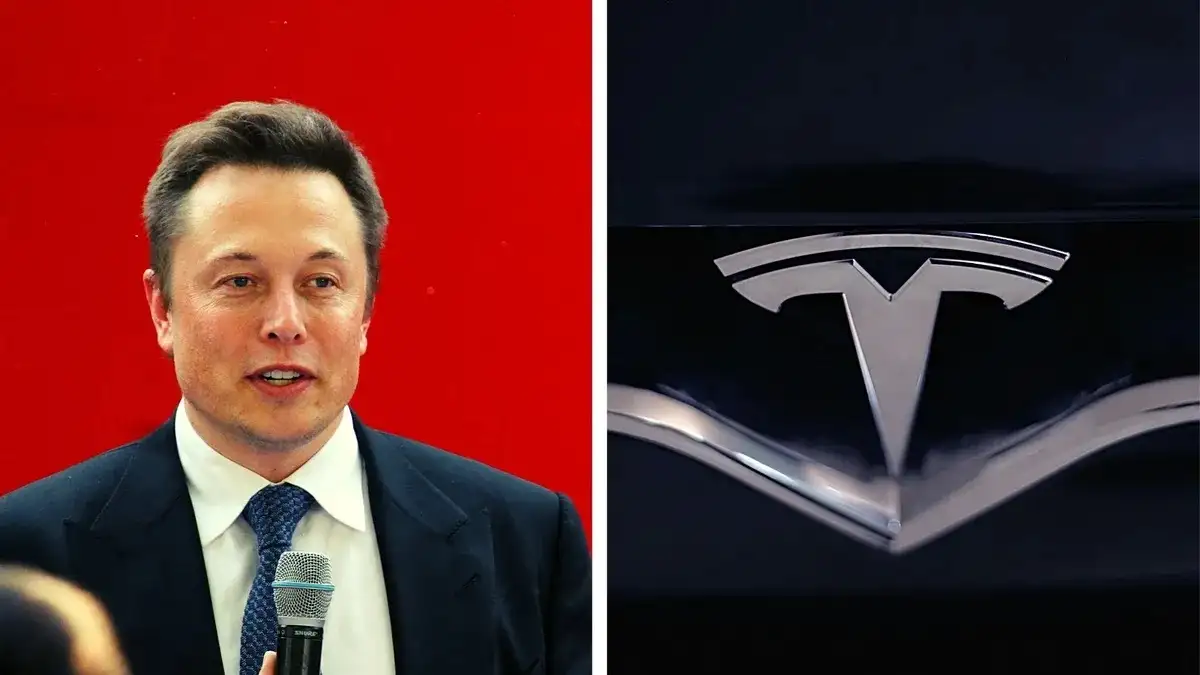

After CEO Elon Musk raised concerns about Tesla’s growth, its stock price plunged more than 12%, its worst decline in over a year.

Tesla’s stock plunged 12% on January 25, its worst decline in over a year, wiping approximately $80 billion in market worth, according to Reuters. Since the month began, the electric vehicle maker’s market worth has dropped $210 billion.

The fall followed CEO Elon Musk’s warning that sales growth will halt despite significant price reduction. Investors worried about sluggish electric vehicle demand and Chinese competition after the billionaire’s judgment.

Elon Musk predicted weaker sales growth as Tesla concentrates on a cheaper next-generation electric vehicle.

The Texas facility will build the electric car in the second part of 2025. He stated modern technology will make it difficult to increase manufacturing of the new car.

TD Cowen analysts saw Tesla data negatively. They stated the electric vehicle maker’s fourth-quarter 2023 revenue and profitability were below estimates. Tesla shares plummeted along with other US electric carmakers. Rivian Automotive, Lucid Group, and Fisker declined 4.7-8.8%.

Since electric car demand has been dropping for over a year, Tesla’s price drops may put further pressure on startups and manufacturers like Ford.

CMC Markets analyst Michael Hewson said Tesla must trade off deteriorating profits to grow sales owing to competition from BYD of China and others.

If Tesla’s sales growth and margins fall, analysts say valuing may become harder. Tony Sacconaghi of Bernstein said Tesla is becoming more like a regular carmaker.