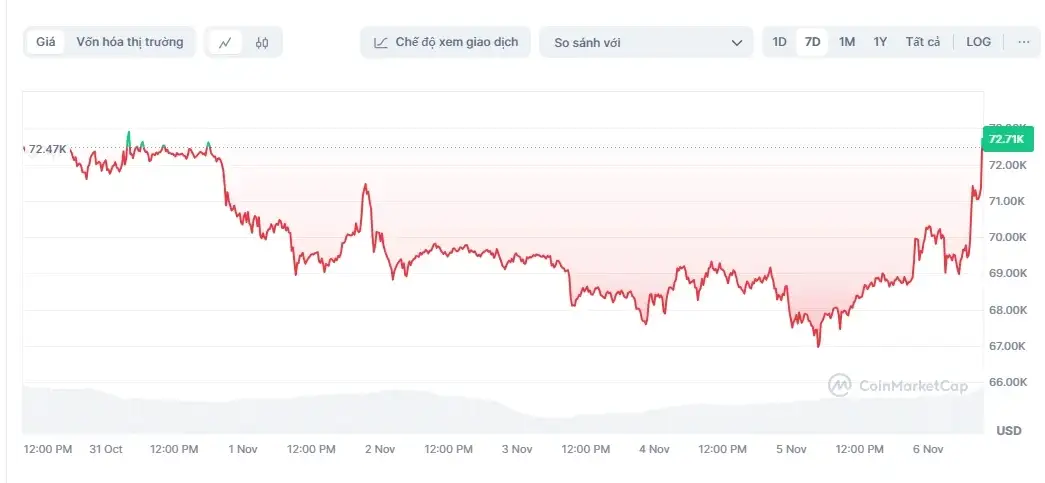

Bitcoin has surged to nearly $75,000, marking a historic high as market volatility spikes amid the ongoing U.S. presidential election. Investors are closely watching, expecting further fluctuations based on the election’s outcome.

This surge comes just as the U.S. presidential election on November 5 enters a heated phase, capturing the attention of global investors. According to data from CoinMarketCap, Bitcoin spiked over 10% within 24 hours, surpassing $74,700 and pushing the market cap of the world’s largest cryptocurrency above $1.4 trillion. Notably, this sharp rise in Bitcoin also boosted the stock prices of related companies, with Coinbase up 3% and MicroStrategy up 4% on the U.S. stock market as of November 5.

According to CNBC, investors predict that Bitcoin’s volatility will persist until the U.S. election results are official. A victory for Vice President Kamala Harris may lead to a temporary dip in Bitcoin, while a win for former President Donald Trump could strengthen confidence in the crypto market, paving the way for Bitcoin to hit new peaks. Ryan Rasmussen, Research Director at Bitwise Asset Management, noted, “Bitcoin and the broader crypto market will likely continue to experience strong volatility until the election results are clear.”

Historically, Bitcoin has reached new highs following U.S. elections. After the 2012, 2016, and 2020 elections, Bitcoin’s price surged by approximately 87%, 44%, and 145%, respectively, within 90 days. This period also aligns with significant policy shifts from the U.S. Federal Reserve and Bitcoin’s halving events, which have positively impacted its price.

During the 2012 election, Bitcoin was priced around $11, but by November 2013, it had surged nearly 12,000% to over $1,100. In 2016, Bitcoin stood at $700 before the election and peaked at $18,000 in December 2017. Four years ago, Bitcoin climbed 478% within a year after the election, reaching $69,000 and later setting a new record above $73,000 in March 2024.

Experts at CryptoQuant highlight that Bitcoin’s current price is reasonable and suggest that if the election acts as a positive catalyst, Bitcoin could set a new record in the coming days. James Davies, CEO of Crypto Valley Exchange, remarked, “Investors are holding cash and are ready to react sharply. Regardless of the election’s outcome, the market is likely to experience significant short-term volatility.”