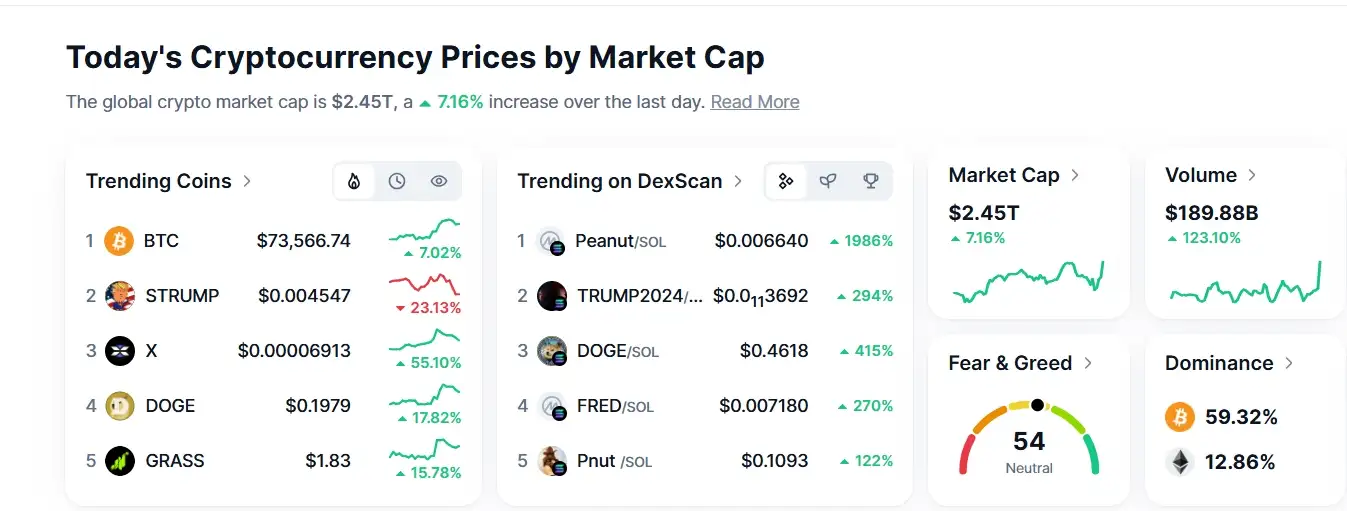

On U.S. Election Day, Bitcoin surged by $6,000 from morning to early afternoon, reaching a historic high of over $75,300 as vote-counting began for the presidential race.

Around 7 a.m. local time (7 p.m. EST), Bitcoin (BTC) spiked sharply, with its price chart showing a near-vertical rise. In under an hour, Bitcoin hit nearly $71,500, marking an increase of more than 3% in mere minutes.

By 9 a.m., the world’s largest cryptocurrency entered another accumulation phase, soon skyrocketing to $74,812 by 10:10 a.m., up 10% compared to the same time yesterday, setting a fresh record high.

Following a midday pause, BTC accelerated again in the early afternoon. By 1:30 p.m., Bitcoin broke through the $75,300 barrier, nearly $6,000 above its morning levels. This price is roughly 2.1% higher than its previous peak of $73,750 from mid-March.

Other digital currencies joined the rally. Ether surged over 7% to surpass $2,600. Binance Coin and XRP recorded gains of around 5-6%, while tokens like Solana and Dogecoin rose at double-digit rates.

The crypto market reacted to preliminary election results showing Republican candidate Donald Trump leading Democratic candidate Kamala Harris. As of 1:30 p.m., Trump held 247 electoral votes, leading Harris by 33 votes.

Many investors had anticipated this Bitcoin rally, betting on a “Trump trade” as markets anticipated a win for Trump, who is seen as friendly toward digital assets. Investors are also concerned about America’s growing public debt, with the budget deficit up 8% in 2024, totaling $1.8 trillion.

However, Bitcoin prices could remain volatile until the election result is officially confirmed. Investors believe a Harris victory might pressure BTC’s price downwards, while a Trump win would likely be positive for the crypto market.

This election is regarded as one of the most significant events for the cryptocurrency industry. Ryan Rasmussen, head of research at Bitwise Asset Management, noted that a Trump victory could lead to a new market peak, while a Harris win might trigger a brief sell-off, followed by a 1-2 month recovery period. Still, Rasmussen predicts a new Bitcoin high soon, regardless of the outcome.

In previous elections (2012, 2016, and 2020), Bitcoin rose by approximately 87%, 44%, and 145% within 90 days post-election. These rallies partially coincide with Bitcoin halving events, which reduce miner rewards and limit BTC’s supply.

Bitcoin’s post-election performance also tends to benefit from significant policy changes by the Federal Reserve (Fed). This year, the market is anticipating further interest rate cuts, reinforcing expectations of a new Bitcoin peak in the coming weeks.

In recent days, BTC has fluctuated between $69,000 and $70,000, which analysts at CryptoQuant deem a reasonable price level. If the election outcome provides favorable catalysts, Bitcoin could very well soar to establish another all-time high in the near future.